- Academically Sound Principles

- Effective And Efficient Processes

- Real Planning For Real People

Fee-Only | Fiduciary | Financial Planning

The financial planning solutions we offer are designed to help you achieve your goals regardless of what stage in life you are currently in. At the end of the day, we are here to help you grow, preserve, and enjoy your wealth.

Investment Management

We believe that investment success is driven by applied research and discipline.

We are in the business of building and managing individually tailored investment portfolios that are individually tailored to meet each client’s needs.

Time Horizon and Risk Tolerance

Two of the most important elements that are always taken into consideration before making an investment decision are Time Horizon and Risk Tolerance. We don't believe in investing just for the sake of investing and we are not "stock pickers." We work with clients to make sure each investment decision is in alignment with their tolerance for risk and is associated with a particular goal that the client hopes to achieve at some point in the future.

The three most important factors that are always taken into consideration when developing an investment portfolio for a client are:

Asset Diversification

What you are invested in: stocks, bonds, cash, crypto, etc.

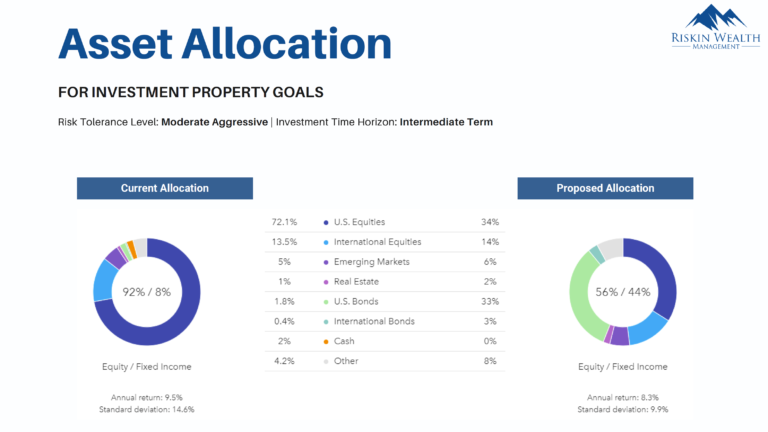

Asset Allocation

How much of the portfolio is invested in each asset class

Asset Location

Where your assets are invested: taxable, tax-deferred, tax-free

By properly incorporating these three elements into our strategy and implementing a disciplined approach to portfolio rebalancing, we can attempt reduce risk and control volatility in order to generate after-tax returns that are sufficient enough for clients to reach their goals.

Here are the steps involved once you become an Investment Management client:

The first step in the process in to complete our online risk tolerance questionnaire so we can start to develop an optimal asset allocation strategy that is aligned with both your tolerance for risk and time horizon.

Whether we are setting up brand new accounts or helping you rollover existing accounts to TD Ameritrade - this is where we currently custody assets for clients - we are here to help facilitate this process and make it as seamless as possible.

After your accounts have been established, we are here to help get you set up with online access through TD Ameritrade's client-facing platform where you can download monthly account statements and relevant tax documents.

After all the administrative work has been completed, we then focus our attention on building investment portfolios that are tailored specifically for you.

After reviewing your responses to the risk tolerance questionnaire and evaluating your investment holdings from a holistic perspective, we build out the portfolios using well-diversified, low-cost, and tax-efficient ETFs and mutual funds.

We believe in rebalancing portfolios on a quarterly basis so that an optimal mix of different asset classes is maintained. Even though we rebalance quarterly, we are still watching the markets and reviewing your allocations on a daily basis in order to be well-positioned to make any necessary adjustments during times of extreme economic, social, and political uncertainty.

When it comes time to distribute funds to pay for your desired goals, we can easily facilitate these transfers to make sure your funds end up directly in your bank account to avoid a check getting lost in the mail or requiring you to make any unnecessary trips to your local bank.

Comprehensive Financial Planning

True financial planning is not static, it’s dynamic and ever-changing.

Here are just a few examples of the areas we focus on when working with clients in an ongoing comprehensive financial planning engagement:

With ongoing comprehensive financial planning, we are focused on taking a deep dive to understand what your personal beliefs, interests, and goals are in order to create a plan that is designed uniquely for you. After we have gathered the necessary personal and financial data, and helped you quantify your goals, we prepare a formal planning report, which provides both our recommendations and the action items that the advisor will be responsible for and those that the client is responsible for.

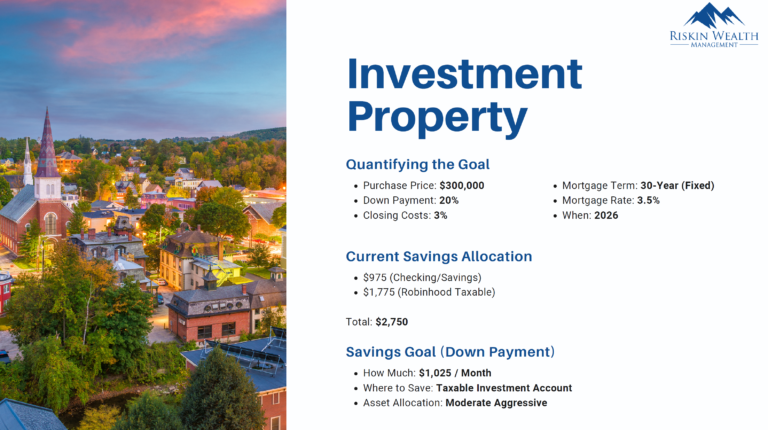

Below are a few examples of common goals found in a financial planning report put together for a younger client:

As mentioned before, financial planning is not a one-time thing, which is why we meet with each client on a quarterly basis (at a minimum) to track their progress towards goals that have been analyzed in the planning report and to also make updates based on circumstances that have changed, new life events that may have occurred, or new goals that have come into the picture since the planning report presentation meeting took place.

Here are the steps involved once you become a Comprehensive Financial Planning client:

The first step in the process is to have an introductory meeting via phone call, videoconference, or in-person in order to learn more about you so we can better understand your current financial standing and what goals you wish to achieve.

After completing our onboarding questionnaire, you will be provided access to fill out our client organizer securely online. This may feel like daunting task at first, but remember that true financial planning is an ongoing process and it is better to think about it like a marathon rather than a sprint! The more information you can provide during this step in the process, the most sound your financial plan will be.

Next, we schedule a follow up meeting to review the information you provided in the client organizer and work together to quantify your goals. We strive to turn general wishes into achievable goals.

Instead of thinking "I would like to retire in my 60s," we work to better define this as "I wish to save enough so I can retire at 65 and spend $100,000 per year without running out of money."

In order to do financial planning in "real time," we utilize state of the art technology applications to run our analysis and validate our recommendations, but most importantly, we use technology to connect you to your plan.

We use the planning applications, RightCapital and Asset-Map, in order to provide a central planning hub where you can get instant access to balances for all of your linked asset and loan accounts, upload/download documents securely, and keep track of monthly, quarterly, and annual tasks that need to get done in order for you to remain on track to reach your goals.

After the comprehensive planning report is built, we meet either virtually or in-person to go over the assumptions used, analysis performed, and recommendations generated to provide clarity and actionable next steps for both you and RWM to prioritize.

While reviewing a custom designed report may feel good, we understand that goals cannot be achieved unless action is taken. After the planning report is presented, we focus on helping you implement any action items that are needed such as rolling over a retirement account to an IRA, re-allocating investments within your employer-sponsored retirement plan, updating tax withholding elections, or initiating RMDs or other distributions to name a few.

Things happen and plans change. This is why being able to monitor accounts in real-time and having frequent touch points allows us to be apprised of any material changes such as being promoted, changing careers, starting a family, relocating, dealing with an unexpected health issue.

This allows us to be proactive instead of reactive in our planning so you can alter course in order to stay on track to achieve your goals.

Even if things are progressing smoothly and there haven't been major changes in your life, we still meet on a quarterly basis in order to review outstanding tasks, build a deeper relationship, and measure the progress you are making towards achieving your goals.

In addition to being able to provide investment management services for clients who choose to work with us in a comprehensive financial planning engagement, we have partnered with Riskin & Riskin, PC (a Connecticut based public accounting firm in which Ross is a Partner) in order to provide income tax preparation services as well. What this means is that we can essentially become your one-stop shop for all of your investment, financial planning, and tax preparation/planning needs!

Investment Management Fees

For investment management services, we use an assets under management (AUM) fee model where a management fee is calculated and usually withdrawn from managed accounts on a quarterly basis.

For example, if we managed a portfolio that maintained a $500,000 balance, the annual investment management fee for the year would be $4,750 ($500,000 x .0095) payable as $1,187.50 ($4,750 / 4) per quarter.

0.95%

$0 - $1,000,000 (AUM)

0.80%

$1,000,001 - $2,000,000 (AUM)

0.65%

$2,000,001 - $3,000,000 (AUM)

Negotiable

$3,000,001 and Above (AUM)

Comprehensive Financial Planning fees

For ongoing comprehensive financial planning services, the fee is determined based on each client’s situation and level of complexity along with whether or not income tax return preparation (Riskin & Riskin, PC) is being provided as well.

$500

Initial Data Gathering Fee

$750 - $7,500

Quarterly Fee Range

It is important to note that the fee ranges stated above represent the highest amounts a client can be charged and it is possible for clients to be charged less than these stated amounts given their existing relationship.